Ever tried explaining to your bank why you’re “suspiciously” depositing money into an online casino at 2 AM? Oh no, officer, I wasn’t hacked, I just fancied a spin on Book of Dead. That’s the joy (or rather, the frustration) of UKGC-regulated gambling. New non GamStop casinos, on the other hand, are where the real fun begins. There are fewer restrictions, bigger welcome bonuses, and no one judging your late-night blackjack sessions.

In this guide, we’ll explore the best new online casinos not on GamStop, uncover high-paying slots, and highlight where UK players can play freely without limits. We’ve rounded up the top casino sites that deliver fast payouts, big games, and unrestricted betting.

Best New Online Casinos 2025 – UK Non GamStop Sites

- Betfred: A go-to for sportsbook fans with an integrated non GamStop casino, Betfred offers new players a £10 bonus when they stake £10.

- Betano: Although new, Betano has a strong focus on sports betting and casino games. New users can enjoy a 100% match bonus up to £100.

- NRG Casino: NRG Casino provides a dynamic gaming experience with a variety of slots not on GamStop, plus a welcome bonus package worth up to £500.

- BoyleSports: BoyleSports combines a comprehensive sportsbook with a diverse casino offering. New customers can claim a £25 welcome package.

- Betway: Betway is celebrated for its user-friendly mobile app and extensive game selection. New players receive a 100% match bonus up to £250.

- Jeffbet: Jeffbet offers a straightforward gaming platform with a variety of games. New users can claim a 100% match bonus up to £100 plus 30 free spins.

- Virgin Bet: Virgin Bet focuses on sports betting with an integrated non GamStop casino section. New players can enjoy a £20 free bet upon meeting the qualifying criteria.

- Sky Bet: Sky Bet offers a comprehensive non GamStop sportsbook alongside a variety of casino games. New customers get £20 free bet when they place a £5 bet.

- Casumo: Casumo excels in fast withdrawals and a vast game library. New players are welcomed with a 100% match bonus up to £300 plus 30 free spins.

- Parimatch: Parimatch offers a robust sportsbook and a growing non GamStop casino section. New users can claim a 100% match bonus up to £30.

- Bwin: Bwin provides a wide range of betting options, including sports and casino games not on GamStop. New players can enjoy a £20 backup bet.

- Paddy Power: Paddy Power is known for its extensive non GamStop sportsbook and entertaining casino games. New customers can claim a £10 risk-free bet.

- Mr Rex: Mr Rex offers a classic casino experience with a variety of games not on GamStop. New players receive a 100% match bonus up to £200 plus 100 free spins.

- Highbet: Highbet provides a range of sports betting options and non GamStop casino games. New users can claim a 100% match bonus up to £50 plus 50 free spins.

- SBK: SBK offers a modern non GamStop betting platform with competitive odds. New customers can enjoy a £20 risk-free bet.

- Rhino Bet: Rhino Bet provides engaging casino games and non GamStop betting. New players can claim a £20 free bet upon meeting the qualifying criteria.

- Sky Casino: Sky Casino offers a premium gaming experience with a variety of high-quality games not on GamStop. New players can enjoy a £60 bonus when they stake £10.

- BetMorph: BetMorph provides a diverse selection of non GamStop casino games and slots. New users can claim a welcome bonus package up to £500 plus free spins.

- Coral Casino: A UK favourite, Coral Casino boasts a solid poker offering and great loyalty perks. New players are welcomed with a £50 bonus when they bet £10.

- William Hill: Renowned for its extensive sports betting platform, William Hill also offers a vast casino selection. New users can claim a 100% match bonus up to £300 on their first deposit.

- SpinYoo Casino: SpinYoo Casino stands out with its modern design and no KYC policy, complemented by a unique loyalty program. New players receive up to £1,000 in bonuses plus 100 free spins across their first three deposits.

- CasiGO Casino: CasiGO Casino entices players with an abundance of free spins and a massive game selection. The welcome package includes up to £1,100 in bonuses and 375 free spins.

- Duelz Casino: Offering a gamified experience, Duelz Casino features slots not on GamStop. New players can benefit from a 100% match bonus up to £100 plus 100 free spins.

- Ladbrokes Casino: An established betting giant, Ladbrokes Casino provides non-GamStop access. New users can claim a £50 bonus when they stake £10.

- 10bet: A top choice for sports betting and live casino enthusiasts, 10bet offers a 100% welcome bonus up to £100 for new players.

- Rizk Casino: Featuring the Wheel of Rizk for wager-free rewards, Rizk Casino provides new players with a 100% match bonus up to £100 plus 50 free spins.

- All British Casino: Focused on UK players, All British Casino offers generous welcome bonuses not on GamStop, including a 100% match bonus up to £100 and 10% cashback on losses.

- MagicRed: Known for high RTP games and fast withdrawals, MagicRed welcomes new players with a 100% match bonus up to £200 plus 100 free spins.

Top 5 New Online Casinos Not on GamStop – Detailed Reviews

NRG – The Best Overall New Non GamStop Casino that doubles as a High-Energy Betting Site

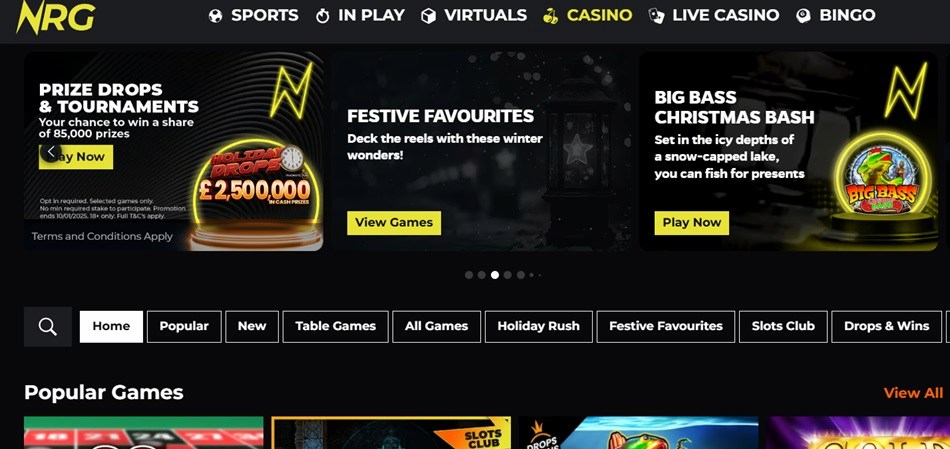

NRG is the kind of online casino that doesn’t mess about. Launched in 2024, this non GamStop casino brings the full package: slots, live dealer games, table classics, bingo, and a sportsbook to rival some of the biggest names in betting.

What makes NRG Casino stand out? It’s one of the rare platforms licensed by the UK Gambling Commission (UKGC), which means it plays by the rules while still offering that offshore casino freedom. There’s no nonsense here, just a sharp interface, a seamless mobile experience, and a steady stream of promotions designed to keep things exciting.

Whether you’re here for high-volatility slots, immersive live casino tables, or a few cheeky accumulator bets, NRG is built to entertain.

Casino Games – Big Names, Big Wins

NRG Casino may not have a bloated library of thousands of games, but what it does have is curated for quality. Every title feels like it belongs. No filler, no fluff.

Slots With Substance

Featuring Pragmatic Play, Relax Gaming, Hacksaw Gaming, and Print Studios, NRG’s slot collection is loaded with top-tier titles. Expect gems like Iron Bank, John Hunter and the Book of Tut Respin, and new weekly releases that keep things fresh.

Table Games That Mean Business

Blackjack? Check. Roulette? Of course. Baccarat? Absolutely. These classic staples are polished and play smoothly across all devices, even if the selection isn’t the biggest.

Live Casino That Feels Legit

Powered by Pragmatic Play Live, the 60+ live dealer tables feature everything from high-stakes blackjack to interactive game shows. The only downside? There’s no bet limit filter, so finding a table that matches your budget takes some digging.

More Than Just Casino

Fancy a punt? The NRG sportsbook is fully integrated, offering a ridiculous variety of betting markets, from Premier League football to darts and even greyhound racing. If you like flipping between online casino and sports betting without switching sites, this setup is a godsend.

Bonuses & Promotions – A Different Approach

NRG Casino doesn’t do cookie-cutter promotions. Instead of a one-time welcome offer, you get recurring rewards.

- NRG Slots Club: Wager £250+ on selected slots between Monday and Sunday to unlock 50 free spins (valued at £5).

- Drops & Wins 2025: A whopping €25,480,000 prize pool from Pragmatic Play, featuring daily tournaments, instant cash prizes, and surprise free spins.

- Summer Nights Boosts: Every Friday night from 9:05 pm to midnight, get boosted payouts on selected games.

What’s the catch? No wagering requirements. That’s right, what you win is yours to keep. While we’d love to see a more traditional welcome package, the fact that NRG’s promotions let you cash out winnings without a fight is a big win in itself.

The only real downside? There’s no VIP program or loyalty scheme. Regulars might feel a little underappreciated in the long run.

Payments & Withdrawals – Fast, Secure, But Limited

Banking at NRG is efficient but not the most flexible.

- Accepted Methods: Visa, Mastercard, Maestro, Visa Electron, Bank Transfers.

- Currencies: GBP & Euros (set at registration).

- Deposit Speed: Instant across all methods.

- Withdrawal Speed: 1-3 business days. No hard caps, but withdrawals over £20,000 require additional verification.

Here’s where things could improve: No e-wallets (PayPal, Skrill, Neteller), no crypto, and no prepaid card options. For a modern casino, that feels like an oversight. If you’re looking for lightning-fast withdrawals via Bitcoin or an e-wallet payout in under 24 hours, you’ll need to look elsewhere.

Pros & Cons of NRG

✅ Legit UKGC Licence: Unlike many non GamStop casino sites UK, NRG is actually licensed by the UK Gambling Commission, meaning top-tier security and fairness.

✅ Wager-Free Promotions: No playthrough requirements on free spins and Drops & Wins prizes.

✅ Handpicked Game Selection: Premium slots and live casino games from Pragmatic Play, Relax Gaming, and Hacksaw Gaming.

✅ Seamless Sportsbook Integration: One-click switch between casino and sports betting.

❌ No Welcome Bonus in the Traditional Sense: Instead of a big one-time bonus, you get rolling promotions.

❌ Limited Payment Options: No PayPal, Skrill, Neteller, or crypto support.

❌ No VIP Program: Loyalty perks are non-existent.

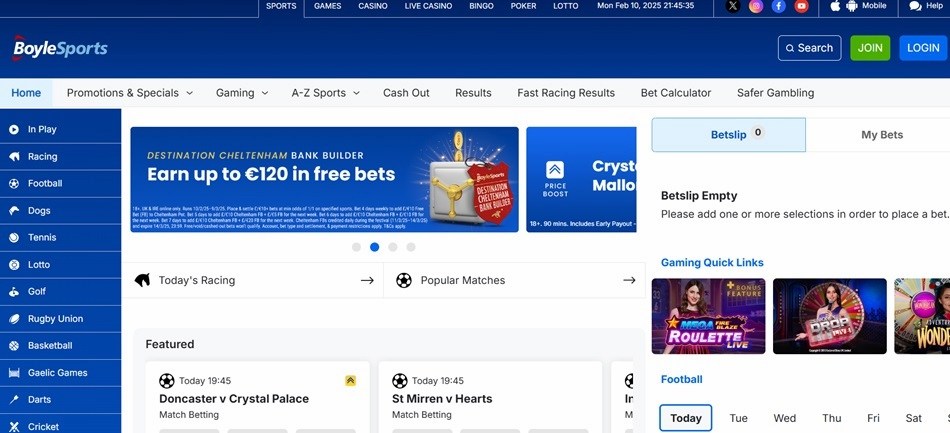

BoyleSports Review – A Premier Sportsbook With Top Acca Offers & Casino Games

BoyleSports has long been a go-to destination for sports bettors, but its casino section is equally impressive. As one of the best non-GamStop casinos with sports betting, it offers a dual experience—from football accumulators to high-stakes slots, all under one roof.

With an exceptional range of sports markets, early payouts, and top-rated online casino games, BoyleSports continues to be a formidable player in the UK betting scene. Their BoyleXtra Loyalty Programme and exclusive promos ensure players always have something extra to play for.

Sportsbook & Betting Markets

BoyleSports covers an extensive range of sports, from football and horse racing to basketball, darts, and American football. Key highlights include:

- Best Odds Guaranteed (BOG) on UK & Irish horse racing.

- Early Payout Offer: Football bets are paid out if your team goes two goals ahead.

- NBA Bet Builder Boost: 25% boost on NBA Bet Builder winnings (minimum odds 3/1).

- Acca Insurance: Money back as a free bet if one leg of your accumulator lets you down.

- Asian Handicap & Bet Builder features for football strategy punters.

For those who like variety, BoyleSports also offers markets on esports, cycling, volleyball, and even political betting. Their betting odds are among the best in the UK, with particularly strong pricing for football and racing.

Bonuses & Promotions

BoyleSports keeps things exciting for both sports bettors and casino players, offering a mix of free bets, odds boosts, and free spins.

For Sports Bettors:

- £25 Bet Bundle for New Customers: Deposit £10 to receive £25 in free bets (split across multiple qualifying bets).

- NBA Bet Builder Boost: Get 25% more winnings on NBA games (min odds 3/1).

- Acca Insurance: Get your stake back as a free bet if one leg of your accumulator fails.

For Casino Players:

- Up to 100 Free Spins: New casino players can claim up to 100 free spins after meeting staking requirements. Spins must be used within 72 hours.

In-Play Betting & Live Streaming

BoyleSports ranks among the best platforms in the UK for in-play betting, offering:

- A well-designed in-play interface with real-time stats.

- Live betting on major sports, including football, rugby, and basketball.

- Live streaming for UK & Irish horse racing.

The cash-out feature is available on most in-play markets, including partial cash-out options. While live streaming could be expanded to more sports, the strong odds and in-play features compensate well.

Casino Games & Features

BoyleSports isn’t just a non GamStop sportsbook. It also boasts a thriving online casino section, making it one of the top non GamStop UK casinos. Players can enjoy:

- Exclusive slots like Samba Claus and Immortal Ways Cleopatra.

- Jackpot King Deluxe – A progressive jackpot slot with huge winning potential.

- Live casino games, including blackjack, roulette, and baccarat.

The platform ensures fair play and security, being licensed by both the UK Gambling Commission and the Gibraltar Gambling Commissioner.

Payments & Withdrawals

BoyleSports supports a wide range of payment methods, including:

- Visa, Mastercard, and Maestro

- Apple Pay & Google Pay

- E-wallets (Skrill, Neteller, PayPal)

- Bank transfers

Minimum deposit: £10

Withdrawals: 3-5 working days

While e-wallet withdrawals are faster than card payments, BoyleSports could improve by offering instant cashouts for all methods or at least reducing casino transaction processing times.

BoyleSports Mobile App & User Experience

The BoyleSports mobile app is one of the best-rated in the UK, with:

- Seamless betting across sports & casino games.

- Live streaming for horse racing.

- A well-optimised bet slip for quick selections.

The desktop site is slightly cluttered, making it intimidating for newer players. However, the mobile version is smooth and easy to navigate. We hope to see the website interface modernised and streamlined rather than looking like an advertisement page from an old newspaper.

Pros & Cons of BoyleSports

✅ BoyleSports is a top-tier sportsbook and casino hybrid, blending elite sports betting features with a strong casino offering. Here’s a breakdown of its standout advantages and drawbacks.

✅ Best for Accumulators: Top-rated Acca Insurance ensures your stake is refunded if one leg of your acca loses. Plus, boosted payouts on multi-leg bets make it a solid choice for accumulator fans.

✅ High-Quality Sportsbook: Covers football, racing, rugby, NFL, and more with highly competitive odds across major leagues and niche sports.

✅ Early Payout Offers: Football bets pay out instantly if your team goes two goals ahead, extending to select NBA, NFL, and rugby matches.

✅ Generous Sports & Casino Bonuses: Offers a £25 Bet Bundle, up to 100 free spins, and exclusive promos for NBA, horse racing, and accumulator bets.

✅ Exclusive & Jackpot Slots Features: unique slot titles like Samba Claus and Immortal Ways Cleopatra, alongside progressive jackpots like Jackpot King Deluxe.

✅ Loyalty Programme & VIP Perks: The BoyleXtra Loyalty Programme rewards both sports and casino players with free bets, prize draws, and in-store cash access.

✅ Live Streaming & In-Play Betting: Provides high-quality streaming for UK & Irish horse racing, plus in-depth live betting options across multiple sports.

✅ Reliable Mobile App: The BoyleSports app is one of the highest-rated in the UK, with a smooth interface, fast bet placement, and live streaming integration.

❌ Limited Esports Betting: The esports market is smaller compared to major competitors, covering only top-tier games like League of Legends and CS:GO.

❌ Withdrawal Speeds Could Be Faster: While deposits are instant, withdrawals can take 3–5 working days, with e-wallets being the only faster option.

❌ Desktop Interface Feels Cluttered: The website can feel overloaded, particularly with football promotions dominating the screen, though the mobile app offers a better experience.

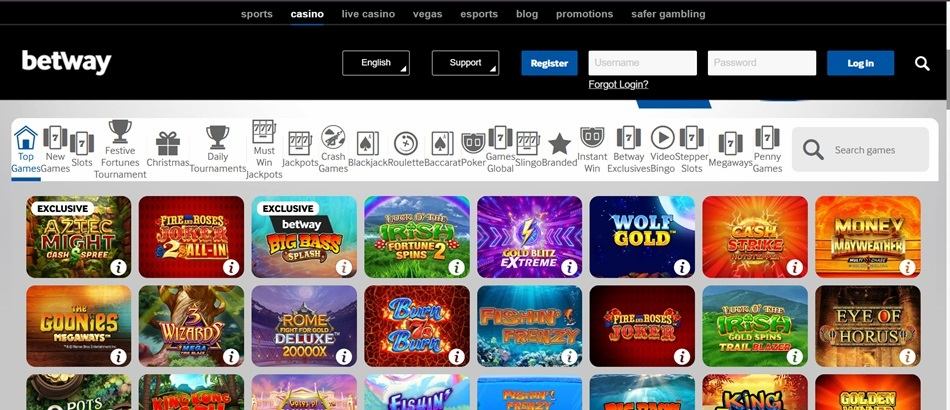

Betway – Best Live Casino Not On GamStop

Betway Casino is a powerhouse of sports betting and online casino gaming founded in 2006 and licensed by the UK Gambling Commission. Betway balances a top-tier sportsbook with an extensive casino section. Whether you’re into high-stakes blackjack, exclusive slot games, or accumulator bets on Premier League football, Betway delivers a seamless betting experience.

With high-profile sponsorships, including Arsenal, Manchester City, and West Ham United, Betway has cemented its reputation as a trusted and premium gaming platform. Its standout features include a dedicated Live Casino, best-in-class esports betting, and one of the UK’s top Free Bet Clubs.

Casino Games & Live Dealer Experience

Betway’s casino section doesn’t just piggyback off its sportsbook reputation. It’s a serious contender in its own right. With 450+ games, a strong focus on live dealer experiences, and a selection of exclusive titles, the casino holds its own among the best.

Slots & Exclusive Games

Betway offers a blend of popular slots and unique, exclusive releases. Players can enjoy standout titles such as:

- Aztec Might Cash Spree

- Luck O’ the Irish Fortune Spins 2

- Gold Blitz Extreme

- 9 Pots of Gold

- Big Bass Bonanza (125 Free Spins Promo Available)

Progressive jackpots like Mega Moolah and Jackpot King Deluxe provide life-changing win potential, making Betway a solid choice for slot enthusiasts.

Live Casino & Table Games

The live dealer section is Betway’s crown jewel, featuring top-tier Evolution Gaming and Pragmatic Play Live tables. Players can enjoy:

- Live Blackjack (including Exclusive VIP Tables)

- European & Atlantic City Blackjack

- Multifire Roulette & Betway Exclusive Roulette

- Crazy Time, Deal or No Deal Live, Monopoly and other interactive game shows

With professional dealers, crisp HD streaming, and exclusive Betway-branded tables, the live casino rivals even the best land-based establishments.

Sportsbook & Betting Markets

For punters, Betway’s sportsbook is one of the most well-rounded in the UK. Covering 30+ sports, Betway excels in football, horse racing, and esports. Key features include:

- Best Odds Guaranteed on UK & Irish horse racing.

- Early Payout Offer: Football bets are settled early if your team goes two goals ahead.

- Acca Insurance: Money back as a free bet if one leg of your accumulator loses.

- NBA Bet Builder Boost: 25% extra winnings on NBA bets (min odds 3/1).

- #BetYourWay: Request custom odds via Twitter.

The esports betting section is one of the strongest in the UK, offering markets on CS:GO, League of Legends, Dota 2, Valorant, Rainbow Six Siege, Rocket League, FC25, and about a dozen more.

Bonuses & Promotions

Betway doesn’t just reward new players—it keeps the perks coming for regulars too. Promotions are split across sports and casino players, ensuring everyone gets a piece of the action.

For Sports Bettors:

- £30 Matched Free Bet + 100 Free Spins (if your first accumulator bet loses).

- Best Free Bet Club in the UK: Wager £25+ on sports multiples each week to earn £10 in free bets.

For Casino Players:

- 100% Casino Welcome Bonus up to £50 (Min deposit: £50, 50x wagering).

- 125 Free Spins on Big Bass Bonanza: No wagering requirements.

- Four to Win (Horse Racing): Free jackpot game where you predict race winners for big prizes.

- Daily Odds Boosts on selected casino and sportsbook games.

Although we would like to see a higher welcome bonus cap, the wager-free free spins and loyalty perks do help Betway stand out as one of the best gambling sites not on GamStop.

Payments & Withdrawals

Betway supports various banking methods, ensuring secure and flexible transactions.

Accepted Payment Methods:

- Debit Cards: Visa, Mastercard, Maestro

- E-Wallets: PayPal, Skrill, Neteller, MuchBetter

- Prepaid Options: PaySafeCard

- Bank Transfers & Trustly

Withdrawal Times:

- Visa Direct & E-Wallets: 12-24 hours

- Bank Transfers & Standard Cards: 2-3 days

Mobile App User Experience

The Betway mobile app has been on the market for many years. As a result, it is among the best when it comes to features and performance. Available on iOS and Android, it offers a clean design, fast bet placement, and seamless navigation. Features include:

- Live Streaming for Horse Racing, Football & Tennis

- In-Play Betting & Cash-Out Options

- Quick Bet Builder for Football & American Sports

Pros & Cons of Betway

Betway stands out as a top-tier sportsbook-casino hybrid, but no online casino is perfect. Here’s a breakdown of its strengths and areas for improvement.

✅ Top Live Casino Experience: Exclusive tables, Evolution Gaming, and immersive game shows.

✅ Best Free Bet Club in the UK: Weekly £10 free bet reward for loyal players.

✅ Exclusive Casino Games: Unique slots like Aztec Might Cash Spree & Gold Blitz Extreme.

✅ Fast Withdrawals for E-Wallets: PayPal, Skrill, and Visa Direct payouts within 12-24 hours.

✅ Best Odds Guaranteed & Acca Insurance: Ideal for accumulator bettors.

✅ Premium Mobile App: Clean design, in-play betting, and live streaming.

✅ Esports Betting Leader: One of the best esports betting platforms in the UK.

❌ Live Chat Support Not 24/7: Only available from 8 AM to midnight.

❌ Casino Welcome Bonus Could Be More Generous: £50 cap with 50x wagering is a bit restrictive.

❌ Desktop Site Feels Overloaded: The mobile app provides a smoother experience.

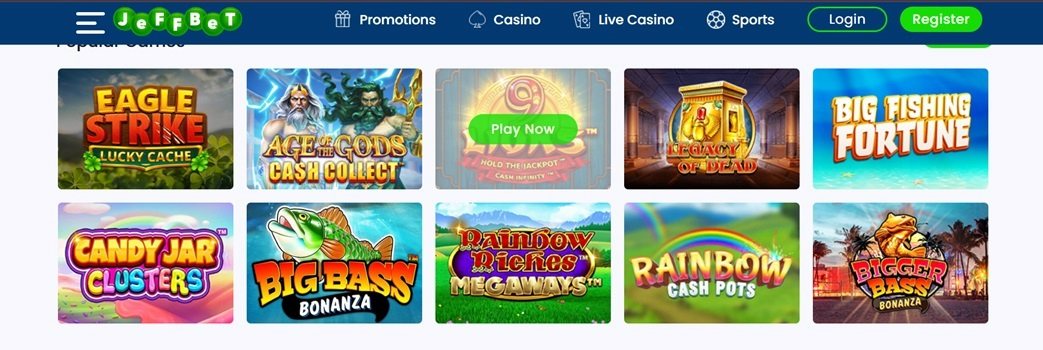

JeffBet Casino Review – A New Non GamStop Casino with Speedy Sign-Up

JeffBet has built its reputation as one of the most user-friendly non-GamStop casinos in the UK, boasting an extensive collection of casino games, sports betting options, and fast withdrawals.

With its one-minute registration process, competitive promotions, and a dual UKGC and MGA license, JeffBet offers a reliable and well-rounded gambling experience.

Game Selection & Features

JeffBet isn’t just another generic casino. It delivers a wide variety of games, including popular slots, live dealer tables, and scratch games. Some standout titles include Rainbow Riches Megaways, Big Bass Bonanza, and Age of the Gods, ensuring a mix of classic hits and modern favourites.

The live casino section is another strong suit, featuring live blackjack, roulette, and baccarat, alongside interactive game shows like Crazy Time and Deal or No Deal Live. JeffBet offers something for every type of player.

For sports betting fans, JeffBet covers a huge range of markets, including football, horse racing, and esports. While the platform doesn’t offer live streaming, it makes up for it with competitive odds and a strong in-play betting section.

Bonuses & Promotions

JeffBet ensures new and existing players have plenty of reasons to stick around with its generous bonus structure:

- Casino Welcome Bonus: 100% match up to £100 + 50 free spins on Rainbow Riches Megaways.

- Minimum deposit: £10

- Wagering requirements: 35x

- Bonus validity: 30 days

- Sports Welcome Offer: Bet £10, get a £30 free bet.

- Minimum qualifying bet: £10 at odds of 1.5 or higher

- Max conversion: £200

- Valid for 7 days

- Weekly Cashback: 10% cashback on losses across EPL, cricket, Formula 1, and Champions League bets, up to £500.

The promotions at JeffBet strike a solid balance between casino and sportsbook offers, giving players flexibility in how they claim rewards.

Fast Transactions & Payment Options

JeffBet supports a big lineup of secure payment methods, including Visa, Mastercard, PayPal, Skrill, Apple Pay, and Paysafecard. Deposits start from just £10, and withdrawals are processed quickly, particularly for e-wallet users.

JeffBet’s fast withdrawal system is a key selling point, with many transactions clearing within 24 to 48 hours. The site also offers a one-minute sign-up process, making it one of the quickest non-GamStop casinos to start playing at.

Pros & Cons of JeffBet

✅ Fastest sign-up process of any non-GamStop casino.

✅ Wide range of casino games, including exclusive slots and live dealer tables.

✅ Multiple secure payment methods, including PayPal and Apple Pay.

✅ Dual licensing from UKGC & MGA, ensuring top-tier security.

✅ Competitive sportsbook with cashback promotions and boosted odds.

❌ No live streaming for sports betting.

❌ Some promotions exclude Skrill and Neteller deposits.

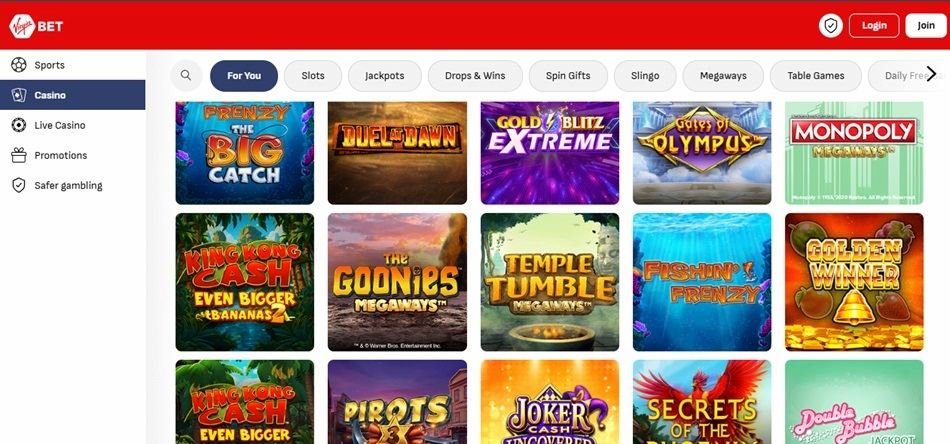

Virgin Bet Casino Review – A Non-GamStop Casino with Top-Notch Table Games and Sports Betting

Virgin Bet is one of the most well-rounded non-GamStop casinos, offering a rich mix of casino games, sports betting, and live dealer tables. With UKGC and Gibraltar approval, this licensed online casino not on GamStop combines trustworthiness with an extensive game library and unique promotions. We especially love the innovative “FIVES” feature that adds a gamified touch to football betting.

Casino Games & Features

Virgin Bet’s casino lobby is packed with high-quality games, catering to a wide range of players. Expect a diverse mix of slots, table games, and live dealer titles. Popular picks include Book of Dead, Gold Blitz, and Eye of Horus, ensuring that classic and modern favourites are available.

If table games are your go-to, Virgin Bet is particularly strong in this area, with multiple blackjack, roulette, and baccarat variations available. The live casino is powered by leading providers, offering an immersive experience with professional dealers.

For sports betting fans, Virgin Bet covers football, horse racing, cricket, and American sports, with live streaming options for select events. Its in-play betting section is among the best, offering real-time stats and dynamic odds changes.

Bonuses & Promotions

Virgin Bet keeps both casino and sports fans entertained with its solid selection of bonuses:

- Sportsbook Welcome Bonus: Bet £10, get £20 in free bets.

- Min qualifying bet: £10 at odds of 1.5 or higher.

- Free bets valid for 7 days.

- Casino Free Spins: 5 free spins on Gold Blitz when wagering £1+ on eligible games.

- Spins valid for 7 days.

- Winnings capped at 20p per spin.

- £5 Free Acca Bet: Earned after placing four £5 accumulator bets.

- Seasonal Promotions: A rotating set of offers, such as the “Win Up to 100 Free Spins” promo running this winter.

One standout feature is Virgin Bet Fives, a free-to-play football betting game where players build a virtual squad and earn cash rewards for each goal their players score.

Fast & Secure Payments

Virgin Bet ensures quick and secure transactions, supporting Visa, Mastercard, PayPal, and Trustly. Deposits start at £5, making it one of the lowest-entry sportsbooks.

Withdrawals are processed efficiently, with e-wallet payouts taking around 24 hours, while card transactions may take 1 to 3 business days.

The low minimum deposit, PayPal support, and quick cashouts make Virgin Bet one of the most convenient non-GamStop betting platforms.

Pros & Cons of Virgin Bet

✅ Strong mix of casino games & sports betting options.

✅ Innovative “FIVES” feature for football betting.

✅ Live streaming available for select sports.

✅ Low £5 minimum deposit with PayPal & Trustly support.

✅ High-quality table games & live dealer selection.

❌ No bet builder for certain sports.

❌ Casino free spins promotions could be more generous.

Why New Gambling Sites not on GamStop Are the Best Thing Since Sliced Bread (If You Like Gambling, That Is)

If you’ve ever felt like a naughty child sneaking into a sweet shop while trying to enjoy a spin at a UKGC casino, you’re not alone. The red tape, affordability checks, and intrusive ID verification can make it feel like you’re applying for a mortgage rather than just wanting to play a bit of roulette. Enter new online casinos not on GamStop, the breath of fresh air for UK players who actually want to, you know, gamble.

Here’s why they’re infinitely better than their UK-licensed counterparts.

1. Freedom to Bet Like a Grown Adult (No UKGC Finger-Wagging)

One of the biggest joys of new non GamStop casinos? No betting limits dictated by the UKGC.

UK-licensed online casinos are currently obsessed with ‘protecting’ players, which is noble in theory, but in practice? It means:

- Deposit caps (because spending your own money is reckless).

- Betting limits (because you’re obviously incapable of self-control).

- Affordability checks (because sending your payslips to a casino sounds totally reasonable).

At new non GamStop casinos, none of that nonsense exists. You can bet £1 or £1,000 in a single spin. Your money, your rules.

2. Win Big Without Being Treated Like a Criminal

You know what’s worse than losing money? Winning money and then getting punished for it.

UKGC casinos have a hilarious habit of suddenly slapping limits on your account if you win too much. They’ll delay withdrawals, restrict your stakes, or shut down your account entirely.

At new casinos not on GamStop, big wins are celebrated, not penalised. There’s no risk of getting blacklisted just for being good at blackjack.

3. Bonus Heaven – More Money, No Wagering Nonsense

Let’s talk bonuses. Because if you’re not playing for a good bonus, what’s the point?

UK casinos have pathetically low bonuses thanks to high taxes and regulations. Meanwhile, new non GamStop casinos throw cash at you like they’re trying to buy your loyalty (and honestly, we’re not complaining).

What you get:

- Bigger welcome bonuses: Often 200% or more (compared to the sad 50% at UK sites).

- More free spins: Hundreds at a time, rather than the token 10 free spins.

- Lower or no wagering requirements: Because no one actually enjoys playing through 50x wagering.

Some non GamStop UK casinos even offer no deposit bonuses, meaning you get free money just for signing up. Try getting that at a UKGC-regulated casino.

4. Pay Your Way – Crypto, E-Wallets, and No Bank Drama

Tried depositing at a UK casino recently? Your bank probably had a panic attack.

“Wait, are you sure you want to spend £50 on this clearly dodgy website you’ve used for years?”

– Some Overprotective Bank, 2025.

UK banks block gambling transactions left, right, and centre, especially on credit cards. But at new non GamStop casinos, you have far more payment freedom:

- Crypto-friendly: Bitcoin, Ethereum, Litecoin, Solana, and even Dogecoin and other meme coins.

- E-wallets galore: Skrill, Neteller, MiFinity, and even Payz.

- Credit card deposits: Something you won’t find at UK casinos.

Plus, withdrawals actually arrive quickly instead of taking a week while a ‘fraud prevention team’ inspects your life choices.

5. Play the Games UK Casinos Don’t Want You To

Did you know UKGC casinos literally ban certain features?

- No bonus buy slots: Say goodbye to skipping straight to the free spins round.

- No auto-spins: Because pressing the spin button yourself is so much safer.

- No exclusive games: If a provider isn’t UKGC-approved, you won’t see their games.

Meanwhile, at new online casinos not on GamStop, you get all the good stuff:

- Bonus buy slots: Activate free spins instantly, no grinding required.

- Auto-spin enabled: Perfect for when you want to gamble but can’t be bothered to click.

- Exclusive titles: Games from developers not licensed in the UK, meaning more variety, better RTPs, and fresh releases.

6. No More “Sorry, You’re Self-Excluded” Pop-Ups

Look, self-exclusion is a great tool for problem gamblers. But let’s be real, sometimes people change their minds. The problem with UKGC?

- GamStop bans last for years and can’t be undone.

- Even if you just wanted a short break, you’re stuck waiting until the full term expires.

- Some players have accidentally self-excluded from ALL UK casinos, including ones they never even joined.

At non GamStop casinos, you have full control over your gambling. If you want to take a break, you do it on your own terms without permanent bans getting in the way.

7. Less Red Tape = Faster Withdrawals

With UKGC casinos, withdrawals can take forever. Why? Because they love throwing random security checks at you. You know the drill:

- Request a withdrawal.

- Get asked for photo ID, proof of address, and a blood sample (okay, maybe not the last one).

- Wait 5-7 business days for your money to finally appear.

Meanwhile, at new UK casinos not on GamStop:

- Crypto withdrawals take minutes.

- E-wallet withdrawals take hours.

- No ridiculous verification checks if you’re using crypto.

Basically, you actually get your money quickly, instead of watching it sit in limbo for a week.

8. Say Goodbye to “Casino Wins Are Taxable” Drama

Fun fact: UK gambling winnings are tax-free, but not everywhere. Some countries tax players directly, while others tax casinos so heavily that they pass the cost onto you through lower RTPs and stingier bonuses.

Since new non GamStop casinos are based offshore, they don’t face the same insane tax burdens. That means:

- Better RTPs: Because they don’t have to scrape extra profits from players.

- Higher bonuses: The tax savings get passed onto you.

- More frequent promotions: Cashbacks, free spins, and deposit matches galore.

Best Casino Games at Non GamStop UK Casinos – More Spins, Bigger Wins

Ever felt like UKGC casinos only offer the same boring old games? You’re not wrong. Play any UK-licensed site for a few months, and suddenly, all the slot reels start looking the same. That’s because they’re limited to UK-approved developers. So say goodbye to bonus buy slots, auto-spins, and exciting new releases.

Meanwhile, at new non GamStop casinos, it’s a completely different playground. With offshore licenses, these sites aren’t shackled by UK regulations, which means they can offer a far bigger and better game library. From high RTP slots and niche table games to massive sports betting markets, there’s no shortage of action.

Let’s break it all down.

Slots Not on GamStop – Bigger Wins, Better Features, No Restrictions

If you think slots are just about pressing spin and hoping for the best, you’ve been playing the wrong slots. At new non GamStop casinos, you get access to:

- Bonus Buy Slots: Tired of waiting for free spins? Just buy straight into the bonus round with games like Money Train 3 (Relax Gaming) or Sweet Bonanza (Pragmatic Play).

- Megaways Slots: Featuring thousands of ways to win, with examples like Buffalo King Megaways (Pragmatic Play) and Great Rhino Megaways (Red Tiger).

- Cluster Pays Slots: No paylines, just massive symbol clusters. Top picks include Reactoonz (Play’n GO) and Jammin’ Jars (Push Gaming).

- Progressive Jackpot Slots: Life-changing wins in one spin. Play Mega Moolah (Microgaming) or Divine Fortune (NetEnt).

- Crypto Slots: Perfect for anonymous gambling, featuring games like BitStarz Billion (BGaming) and Wolf Gold (Pragmatic Play).

- Retro and Classic Slots: Old-school reels with modern RTPs. Try Fire Joker (Play’n GO) or 777 Strike (Red Tiger).

Unique Slot Providers at Non GamStop Casinos

Forget just NetEnt and Microgaming (or Apricot, for the up-to-date ones). Offshore online casinos feature hidden gems like:

- Hacksaw Gaming: Creators of Wanted Dead or a Wild, offering ultra-volatile slots where one spin could pay 12,500x your bet.

- Nolimit City: Known for brutal volatility with slots like Mental and San Quentin where wins can hit 150,000x your bet.

- Betsoft: 3D slot pioneers, famous for cinematic games like Good Girl Bad Girl and The Slotfather.

- BGaming: Crypto-friendly slots like Elvis Frog in Vegas, designed for anonymous casinos.

- Booming Games: Smaller but mighty, with high-RTP slots like Booming Seven Deluxe.

Table Games & Live Casino – Real Action, No Silly Restrictions

Table games at UK casinos can feel limited and watered-down. No side bets, no VIP high-roller tables, and live dealers that look like they just finished a double shift at Tesco’s. At new non GamStop casinos, you get full-throttle table gaming, including:

Blackjack – More Variations, More Fun

- Classic Blackjack: Standard rules, low house edge.

- Multihand Blackjack: Play up to five hands at once for higher stakes.

- Free Bet Blackjack: Get free double-downs and splits for extra action.

- Blackjack Switch: Swap cards between two hands to improve your odds.

- Infinite Blackjack: One hand for unlimited players, with side bets like Hot 3 and Bust It. A must-try by Evolution Gaming.

Roulette – High Stakes, Big Thrills

- European Roulette: Classic version with single-zero layout for lower house edge.

- Lightning Roulette: Features multiplier wins up to 500x. A special game by Evolution Gaming.

- Double Ball Roulette: Two balls in play, twice the winning chances.

- French Roulette: Better odds thanks to the La Partage rule.

Baccarat – High Roller Favourite

- Speed Baccarat: Fast-paced, no waiting between rounds.

- No Commission Baccarat: No extra charges on banker wins.

- Dragon Tiger: A simplified baccarat where you bet on either Dragon or Tiger.

Unique Live Casino Developers at Non GamStop Casinos

- Ezugi: Specialist in Indian casino games like Teen Patti and Andar Bahar.

- Asia Gaming: Focuses on high-stakes VIP baccarat for real whale bettors.

- BetGames.TV: Offers unique games like War of Bets and Dice Duel.

Sports Betting at Non GamStop Casinos – Where the Real Action Happens

Think sports betting at UK sites is great? Wait until you see what Gambling sites not on GamStop offer.

More Betting Markets

- Football: English Premier League, Champions League, World Cup, and even non-league matches.

- Horse Racing: UK, Irish, and global races, including the Kentucky Derby & Melbourne Cup.

- Esports: Bet on CS:GO, Dota 2, LoL, Call of Duty, and FC25 (formely FIFA) tournaments.

- Virtual Sports: Instant betting on simulated horse racing, football, and greyhounds.

Higher Betting Limits

UK sportsbooks often cap maximum stakes, but non GamStop sportsbooks don’t. Want to bet £50,000 on a Premier League game? Go ahead.

Live Betting with Instant Cashouts

Many new casinos not on GamStop offer live in-play betting with cash-out options. Meaning you can lock in a profit before the game ends.

Crypto Betting – Anonymous & Instant

Forget slow bank withdrawals. Bet with Bitcoin, Ethereum, or USDT and get instant payouts.

Live Streaming & Unique Markets

- Asian Handicap betting

- Player performance bets (goals, assists, cards)

- Live-streamed esports matches

Final Verdict – Why Non GamStop Casinos Win on Game Selection

If you want bigger wins, better slots, real table action, and high-stakes sports betting, new non GamStop casinos are the way to go.

- More slot features (bonus buys, Megaways, cluster pays).

- No table game restrictions (play high-stakes blackjack, roulette, and baccarat).

- Live casino with unique developers (Ezugi, Asia Gaming, BetGames.TV).

- Massive sports betting markets with no stake limits.

Welcome Bonuses at New Non-GamStop Casinos – Free Money or a Clever Ruse?

Casino bonuses, the shiny bait dangled in front of every new player, promising stacks of free cash, endless free spins, and the gambling dream. But let’s be honest, most UKGC-regulated casinos offer bonuses so tiny they wouldn’t excite a goldfish. Meanwhile, new non GamStop casinos throw massive welcome offers, cashback rewards, and VIP perks at you like confetti at a wedding.

So, are these bonuses actually good, or is there always a nasty surprise hidden in the fine print? Let’s break it all down, from the biggest and best bonuses to the sneaky terms you need to watch out for.

The Best Welcome Bonuses & No Deposit Offers at Non GamStop Casinos

If there’s one thing the best casinos not on GamStop do better than UKGC sites, it’s the welcome bonuses. Offshore casinos don’t have the UK Gambling Commission breathing down their necks, meaning they can offer:

- 100% – 500% deposit matches (UK sites struggle to offer even 50%)

- No deposit bonuses: Free money just for signing up

- Hundreds of free spins: Not just 10-20 like UKGC sites

- Low or no wagering requirements: Some bonuses actually let you withdraw your winnings

The Most Common Welcome Bonuses

- Deposit Match Bonus: The casino matches your deposit by 100%-500%. Deposit £100? Get £500 free to play with.

- Free Spins Bonus: Get up to 500 free spins on slots like Big Bass Bonanza or Book of Dead.

- No Deposit Bonus: Play for free without spending a penny. (Too good to be true? Sometimes, yes.)

- Hybrid Bonus: A mix of bonus cash + free spins, like 100% up to £200 + 100 free spins on Starburst.

- Cashback Welcome Bonus: Lose money? Get 10%-20% of it back as real cash. (A rare breed but worth hunting down.)

More Than Just Welcome Bonuses – 10 Other Non GamStop Casino Bonuses You Should Know About

Welcome bonuses are just the beginning. At new non GamStop casinos UK, the promotions never stop coming.

Reload Bonuses – A Second (or Third) Bite at the Cherry

Who says bonuses should only be for new players? Reload bonuses offer extra cash on future deposits, usually 50%-200%.

Cashback Bonuses – Losing Shouldn’t Hurt That Much

If you lose money, you get a percentage of it back (often 10%-20%)

- Some casinos offer daily, weekly, or monthly cashback

- No wagering cashback is the best – real money straight to your account

Free Spins – The Gift That Keeps on Giving

- Some casinos throw in free spins every week

- 50 free spins on Fridays, 100 on your birthday, 500 if you sell your soul (just kidding… probably).

No Wagering Bonuses – Because Who Wants to Bet 50x to Withdraw?

- No strings attached. What you win is yours to keep.

- A new non gamstop casinos no deposit bonus will always be worth more than a UK site’s.

VIP & Loyalty Rewards – The Casinos That Actually Appreciate You

- Earn points for playing and exchange them for free bets, real cash, or holidays.

- VIPs get exclusive bonuses, lower wagering requirements, and priority withdrawals.

High Roller Bonuses – For Players that Like to Go Big

- If you deposit £1,000+, expect a bigger bonus than the average player.

- Exclusive tables, better rewards, and faster payouts.

Tournaments & Competitions – A Chance to Win Big Without Spending Big

- Prize pools often hit £50,000+ (and even run into multi-millions) in non GamStop casino tournaments.

- Daily slot races, live blackjack competitions, and leaderboard challenges.

Sports Betting Free Bets – Perfect for Punters

- Bet £10, Get £20 in free bets.

- Risk-free bets and enhanced odds on football, horse racing, and esports.

Crypto Bonuses – The Future of Gambling?

- Many offshore online casinos reward crypto players with exclusive bonuses.

- Deposit with Bitcoin, Ethereum, or USDT and get bigger bonuses than fiat players.

Birthday & Special Event Bonuses – Everyone Loves Gifts

- Free spins, cashback, or deposit matches on your birthday.

- Special promotions on Christmas, Halloween, and big sporting events.

Non GamStop Bonus Terms & Conditions – The Sneaky Stuff Casinos Don’t Want You to Notice

All online casinos, UK non GamStop sites included, place restrictions on bonuses. Here’s what to watch out for before claiming an offer.

Wagering Requirements – The Fine Print That Kills a Bonus

- If a £100 bonus has 40x wagering, you need to bet £4,000 before withdrawing anything.

- The best bonuses have 10x or lower wagering (or none at all).

Time Limits – Don’t Sleep on Your Bonus

- Most casinos give you 7-30 days to use bonuses before they disappear.

- Free spins often expire within 24-48 hours (so use them ASAP).

Maximum Bet Limit – No £100 Spins Allowed

- Most casinos cap bonus bets at £5 per spin (go higher, and your winnings won’t count).

- Check the fine print or risk losing everything.

Game Restrictions – Not All Games Count Towards Wagering

- Slots usually contribute 100%.

- Table games contribute 5%-10% (if at all).

- Live casino bets? Sometimes completely excluded.

Maximum Win Limits – The Ultimate Scam Move

- Some casinos cap your bonus winnings at £500-£1,000 (even if you win more).

- Always check the T&Cs before going on a winning streak.

Payment Method Restrictions – No Bonus for Certain Deposits

- Some casinos exclude Skrill, Neteller, and crypto deposits from bonuses.

- Always check if your preferred payment method is eligible.

How to Claim a Welcome Bonus at a Non GamStop Casino – The Simple Step-by-Step Guide

Choose a Reputable Casino

Pick a site with good reviews, strong bonuses, and fair T&Cs.

Sign Up & Verify

Registration usually takes two minutes. (No ID needed at some casinos!)

Check Bonus Terms

Don’t get caught out by high wagering or sneaky restrictions.

Make a Deposit

Use a payment method that qualifies for the bonus.

Enter Bonus Code (If Needed)

Some casinos require a promo code at sign-up.

Claim the Bonus

It should appear instantly in your account.

Start Playing

Stick to eligible games to make sure your bets count.

Complete Wagering (If Required)

Fulfil the playthrough before attempting a withdrawal.

Cash Out Your Winnings

If everything checks out, your money is yours to keep.

Non GamStop Casinos in the UK – Are They Safe or a Risky Bet?

There’s always that one bloke who insists that “if a casino isn’t UKGC-licensed, it’s obviously a scam“. Bless him. The reality is that non GamStop casinos in the UK can be just as safe (if not safer) than their UKGC-approved counterparts. But, like anything in life, you need to know what to look for.

So, are gambling sites not on GamStop safe? Let’s break it down — licenses, legalities, and scam warnings included.

Are Non GamStop Casinos Licensed? – The Offshore Watchdogs Keeping Things Legit

The biggest misconception about new non GamStop casinos is that they’re unregulated. In truth, most operate under offshore gaming licenses from well-known regulatory bodies. These aren’t some dodgy, back-alley approvals. Many of these regulators have been in the business for decades.

Here are five of the most common offshore gambling licenses:

1. Curaçao Gaming Control Board – The OG Offshore License

- One of the oldest and most widely used gaming regulators.

- Covers hundreds of online casinos and sportsbooks.

- Crypto-friendly, allowing casinos to accept Bitcoin, Ethereum, and USDT.

- Offers basic consumer protection, but not as strict as the UKGC.

2. Malta Gaming Authority (MGA) – The European Favourite

- Considered one of the most reputable offshore regulators.

- Requires online casinos to pass strict fairness and anti-money laundering tests.

- Audited by independent bodies like eCOGRA to ensure fair play.

- Offers dispute resolution services for players who feel cheated.

3. Gibraltar Gambling Commission – The UK’s Offshore Neighbour

- Many UK-facing non GamStop casinos hold a Gibraltar license.

- Operates under UK-like standards, but without GamStop restrictions.

- Ensures fund segregation, meaning casinos can’t run off with your money.

4. Panama Gaming Control Board – The Crypto Casino King

- One of the most crypto-friendly regulators in the gambling industry.

- Attracts high-stakes online casinos that accept Bitcoin, Litecoin, and USDT.

- Less strict on KYC, meaning faster withdrawals and private gaming.

5. Kahnawake Gaming Commission – The North American Heavyweight

- Based in Canada, but licenses online casinos worldwide.

- Requires regular game audits for fairness.

- Focuses on responsible gambling, offering self-exclusion tools.

How to Verify a Casino’s License: Scroll to the bottom of the casino’s website. You should see the license number and regulatory body logo. If you’re unsure, cross-check it on the regulator’s official website.

Can UK Players Legally Play at Non GamStop Casinos?

The short answer? Yes, absolutely. The UK Gambling Commission (UKGC) only regulates UK-licensed casinos. It has zero control over offshore casinos. That means:

- You won’t break any UK laws by playing at new casinos not on GamStop in UK.

- Offshore casinos are completely legal to use in the UK.

- UK banks may block some transactions, but crypto and e-wallets solve this issue.

But What About Tax?

- Gambling winnings are 100% tax-free at non GamStop casinos in the UK.

- Unlike some countries where winnings are taxed, UK players keep 100% of their profits.

So, if you hit a massive win on an offshore site, HMRC won’t come knocking (as long as the online casino isn’t UK-based).

Avoiding Scams – How to Pick a Safe Non GamStop Casino

Now, while there are plenty of legitimate offshore casinos, there are also a few sketchy ones. Here’s how to avoid getting scammed.

1. Check the License (Or Lack of One)

Licensed by Curaçao, Malta, Gibraltar, Panama, or Kahnawake = Generally safe.

No license or “random Caribbean island regulator” = Run for the hills.

2. Look for Game Certifications

Safe casinos use tested and certified software from:

- eCOGRA

- GLI (Gaming Laboratories International)

- iTech Labs

If an online casino has no certifications, it could mean rigged games.

3. Read Real Player Reviews

Before depositing, Google the casino’s name + ‘scam’ and see what comes up. If players are complaining about unpaid winnings, avoid it.

4. Check Withdrawal Limits & Processing Times

- Reputable casinos process withdrawals within 24-48 hours.

- Scam casinos make you wait weeks (or never pay out at all).

- Some shady casinos have “hidden fees” on withdrawals. Always check the T&Cs.

5. Test Customer Support Before Depositing

A legit online casino should have:

- 24/7 live chat support.

- Fast email responses (under 24 hours).

- A proper FAQ section, not just vague, copy-pasted nonsense.

Pro tip: Try asking a simple question. If they take forever to reply, imagine what they’ll do when you try to withdraw your winnings.

6. Use Safe Payment Methods

- Cards, cryptocurrencies, and e-wallets (Skrill, Neteller, Payz) are the safest and fastest.

- Avoid casinos that only accept wire transfers (this is a huge red flag).

7. Stick to Well-Known Casinos

If an online casino just launched last week and has no reviews, maybe wait a bit before depositing your life savings.

Summary – Are Non GamStop Casinos Safe?

If you choose wisely, yes, non GamStop casinos are absolutely safe. They operate under reputable offshore licenses, use fair game testing agencies, and provide real player protections.

Fully legal for UK players.

Better bonuses and bigger payouts than UKGC sites.

Crypto-friendly, fast withdrawals, and no affordability checks.

But choose the wrong site, and you could be dealing with:

Slow withdrawals (or no withdrawals at all).

Fake games with rigged RTPs.

Dodgy customer service that disappears when you need them.

Best Non GamStop Casino Payment Methods – Fast, Flexible & Frustration-Free

When withdrawing winnings from a UKGC-regulated casino, you’ve probably experienced the joy of sending five different documents, waiting a week, and then being told your bank “declined the transaction for your own safety.” Ah, how thoughtful.

At non GamStop casinos, deposits are instant, withdrawals don’t take a lifetime, and you can actually use crypto without a bank meltdown. Whether you prefer traditional cards, e-wallets, or Bitcoin’s untraceable magic, offshore casinos give you more payment options and fewer headaches.

Crypto Casinos with No KYC – The Future of Gambling?

The rise of Bitcoin, Ethereum, and USDT casinos isn’t just a tech trend — it’s a revolution. Crypto casinos not on GamStop offer something UKGC sites never will:

- No KYC (Know Your Customer) checks: No ID, no documents, no problem.

- Instant deposits and withdrawals: Your winnings land in your wallet in minutes, not days.

- Ultra-low fees: No greedy banks taking a cut.

- Anonymity: Perfect for players who like privacy.

Most Popular Cryptocurrencies at Non GamStop Casinos

- Bitcoin (BTC): The OG of digital money, widely accepted.

- Ethereum (ETH): Faster than Bitcoin, perfect for quick withdrawals.

- Tether (USDT): A stablecoin, meaning no wild price swings while you gamble.

- Litecoin (LTC): Low fees and fast transactions, ideal for smaller bets.

- Dogecoin (DOGE): For gamblers who like memes with their money.

Why Crypto Casinos are a Game-Changer

- No third-party interference: No blocked payments, unlike traditional banking.

- Better bonuses: Many non GamStop casinos offer crypto-exclusive promotions.

- Massive betting limits: Some sites allow deposits up to £50,000 in crypto.

The Downsides

- No chargebacks: Once you send crypto, it’s gone. Choose a reputable casino.

- Highly volatile: Bitcoin’s value today might be completely different tomorrow.

Traditional Payment Methods – The Safe (But Slow) Choice

For those who still trust banks with their money, non GamStop casinos offer traditional payment options too. While slower than crypto, they’re reliable and widely accepted.

Debit & Credit Cards (Visa & Mastercard)

If you have a bank account, then in all likelihood, you have a debit or credit card which you can use for online gambling transactions.

Pros:

✅ Familiar and easy to use.

✅ Accepted at new casinos not on GamStop in UK.

✅ No need to set up extra accounts.

Cons:

❌ Some UK banks block transactions to offshore casinos.

❌ Withdrawals take 1-3 business days.

❌ Some casinos charge fees (especially for credit cards).

Bank Transfers – The Dinosaur of Payment Methods

Once the gold standard of online gambling payments, bank transfers are now seen as too slow for modern gamblers.

Pros:

✅ Highly secure: No risk of chargebacks.

✅ Can be used for both deposits and withdrawals.

Cons:

❌ Deposits take 1-3 business days.

❌ Withdrawals take 3-5 business days (that’s practically prehistoric in gambling time).

❌ Many banks automatically flag gambling transactions (cue the awkward call from your bank).

E-Wallets & Instant Withdrawals – The Sweet Spot Between Speed & Security

E-wallets have exploded in popularity at non GamStop UK casinos, and for good reason. They offer blazing-fast transactions, tight security, and no banking drama.

Best E-Wallets for Non GamStop Casinos

- Skrill: Widely accepted, quick withdrawals, but some casinos exclude it from bonuses.

- Neteller: Similar to Skrill, great for high-rollers but some fees apply.

- PayPal: Rare at offshore casinos, but when available, one of the safest.

- MiFinity: Lesser-known but low fees and quick transactions.

- MuchBetter: Great for mobile payments, but not all casinos support it.

Why E-Wallets are King for Fast Withdrawals

- Instant deposits: Money appears instantly in your account.

- Withdrawals in under 24 hours: Some sites even process withdrawals in minutes.

- Safe and secure: Your bank details stay hidden from the casino.

The Downsides

- Not always eligible for bonuses (check the T&Cs before depositing).

- Some wallets charge withdrawal fees.

Other Payment Methods – The Niche Options

While crypto, e-wallets, and cards dominate, some gamblers prefer alternative methods.

Paysafecard – The Anonymous Choice

- Prepaid voucher, meaning no need to link your bank.

- Great for deposits, but can’t be used for withdrawals.

Mobile Payments – Apple Pay & Google Pay

- Super convenient for deposits on mobile.

- Not available for withdrawals, which is a bit annoying.

Trustly – Fast Bank Transfers

- Instant deposits and withdrawals.

- High security, but not every non GamStop casino offers it.

Comparing Payment Methods – Which One is Right for You?

| Payment Method | Deposit Time | Withdrawal Time | Best For |

| Crypto (BTC, ETH, USDT) | Instant | Instant to 1 hour | Privacy & fast payouts |

| Debit/Credit Cards (Visa/Mastercard) | Instant | 1-3 business days | Convenience |

| E-Wallets (Skrill, Neteller, PayPal) | Instant | Within 24 hours | Fast withdrawals |

| Bank Transfers | 1-3 business days | 3-5 business days | High-limit transactions |

| Paysafecard | Instant | Not available | Anonymous deposits |

| Apple Pay / Google Pay | Instant | Not available | Mobile convenience |

| Trustly | Instant | Instant | Fast bank transfers |

Final Verdict – What’s the Best Way to Pay at Non GamStop Casinos?

It all depends on what you value most.

- Want the fastest, safest, and most private option? Crypto is king.

- Prefer a mix of speed & security? E-wallets like Skrill & Neteller win.

- Like old-school reliability? Visa & Mastercard still get the job done.

- Want full anonymity? Paysafecard is your best bet.

The advantage of new non GamStop casinos is the variety of payment methods that fit your style without the UKGC breathing down your neck.

Conclusion

Stepping into the world of new non-GamStop casinos is like finding a hidden speakeasy. They’re exclusive, thrilling, and packed with surprises. Each online casino we’ve explored brings its own brand of excitement to the table.

Here’s a final roll call of the top contenders:

The Sportsbook Titan – BoyleSports

A household name that’s been perfecting the art of betting for decades, BoyleSports isn’t just a sportsbook, it’s THE sportsbook. With top-tier odds, massive event coverage, and a seamless betting app, it’s the perfect fit for punters who take their wagers seriously.

The Fast-Payout Specialist – NRG Casino

NRG is the best non GamStop casino for players who don’t like to wait. Offering lightning-fast deposits and withdrawals. Throw in a diverse game selection and strong promotional offers, and you’ve got one of the speediest and most rewarding platforms around.

The Esports & Betting Powerhouse – JeffBet

If you’re into sports betting but want a serious esports offering as well, JeffBet has your back. Covering everything from football and horse racing to CS:GO and League of Legends, this site is a dream for punters who love a varied betting landscape.

The High-Stakes Haven – Betway

Betway is where the high rollers play. With huge payout potential, premium live betting features, and a stellar casino lineup, it’s the ultimate destination for those who like to bet big and win bigger.

The Gamified Experience – Virgin Bet

With its unique Virgin Bet Fives game, a strong sportsbook, and a solid casino lineup, Virgin Bet is where betting meets entertainment.

FAQs – Non GamStop Casinos Explained in 60 Seconds

1. Are non GamStop casinos legal in the UK?

Yes, absolutely. New non GamStop casinos operate under offshore gaming licenses (like Curaçao or Malta), making them completely legal for UK players. The UKGC can’t block you from playing, they just don’t regulate these sites.

2. What’s the best Online casino not on GamStop?

That depends on what you want. High bonuses? Try SpinYoo or Betano. Fast withdrawals? Go for Casumo or NRG. No KYC casinos? Bitcoin-friendly sites like BetMorph or Monster Casino are your best bet.

3. Do non GamStop casinos offer no deposit bonuses?

Yes, but read the fine print. Some casinos throw out free spins or bonus cash without a deposit, but most have sneaky wagering requirements. The best offers have low or no wagering at all.

4. Are non GamStop casinos safe for UK players?

If you pick a licensed, reputable site, then yes. Look for casinos with Curaçao, Malta, or Gibraltar licenses, SSL encryption, and fair game certifications from eCOGRA or iTech Labs. Avoid shady, unlicensed casinos that nobody’s heard of.

5. Can I use PayPal at non GamStop casinos?

Rarely. While some new casinos not on GamStop accept PayPal, most prefer Skrill, Neteller, or crypto instead. If PayPal is a dealbreaker, check the banking page before signing up.

6. Can non GamStop casinos ban me for winning too much?

Unlike UKGC casinos, which sometimes limit high rollers, most non GamStop casinos don’t penalise winners. Some even reward big spenders with VIP perks and higher withdrawal limits.

7. Do I have to verify my identity at non GamStop casinos?

Depends. Crypto casinos with no KYC let you deposit, play, and withdraw without any ID checks. Others may only require verification for large withdrawals.